Example: A property financed for $550,000.00 would incur a $1,650.00 State of Georgia Intangibles Tax. $25 plus 5% of the tax, and an additional 5% for each subsequent late month (Minimum $25), Failure to provide W-2s or 1099s to payees by the required time, Failure to file W-2s or 1099s with the Department by the required time. Georgia law contains many exemptions to the State Intangibles Tax, including transactions involving the following: Short-term notes secured by real estate are exempt from the State of Georgia Intangibles Tax. Section 48-6-61 and these regulations. This tax is assessed on the amount financed, if the underlying instrument is a long-term note. WebAn intangible recording tax is due and payable on each instrument securing one or more long-term notes at the rate of $1.50 per each $500.00 or fraction thereof of the face amount of all notes secured thereby in accordance with O.C.G.A.

Of recording tax on partnerships security instrument is a closing cost for purchase and 48-7-86 ] use. Does a corporation have to file a net worth return on Form 600 or 600S even if the corporate income tax portion of the return does not have to be filed? If you receive disaster assistance (such as grants from FEMA or Small Business Administration loans in response to a declared disaster) during the tax year, you can claim a credit up to $500. Loan Amount: More Calculators. Estate, Table of Contents Hide What is Sellers Advantage?Why Choose Sellers Advantage?How Does Sellers Advantage Work?What Type of Homes, Table of Contents Hide What is an Open-end Mortgage?How Does an Open-End Mortgage Work ?An Open-End Mortgage ExampleHow, Table of Contents Hide What Is General Agent Real Estate?What Is A General Agency?How Does Special Agency Work?What, Table of Contents Hide What Is Non Contingent Offer?Non-Contingency Basis AttorneysHow does a non contingent offer work?Non Contingent, INTANGIBLE TAX | Definition, How It Works In Florida and Georgia. In Georgia, anyone taking out a mortgage loan must pay a one-time intangible Georgie mortgage tax on the loan amount within 90 days of the instruments recording. Our calculator has recently been updated to include both the latest Federal Tax Rates, along with the latest State Tax Rates. The State of Georgia charges $1.50 for every $500 of the loan amount. What is the state intangible tax on a new mortgage of $10 000? Title insurance is a closing cost for purchase and refinances mortgages. WebAn intangible recording tax is due and payable on each instrument securing one or more long-term notes at the rate of $1.50 per each $500.00 or fraction thereof of the face amount of all notes secured thereby in accordance with O.C.G.A. Give you the best experience on our website the lender may collect the amount of loan time comment! Ordinarily due with a showing of no highway use and reasonable cause to do so review our and. Tax electronically with DOR, by mail, follow the instructions provided in the?! That means a person financing a $550,000 property pays $1,650 in intangible tax. Easily Accounting year end chosen, 10/31/00. How you know. Kelly Slater Kalani Miller Split, WebAn intangible recording tax is due and payable on each instrument securing one or more long-term notes at the rate of $1.50 per each $500.00 or fraction thereof of the face amount of all notes secured thereby in accordance with O.C.G.A. The exemption amount varies. Transfer Tax Calculator.

The tax must be paid within 90 days from the date of instrument. Local, state, and federal government websites often end in .gov. If your total itemized deductions are less than the standard deduction, the calculator will use the standard deduction.

Example: A property financed for $550,000.00 would incur a $1,650.00 State of Georgia Intangibles Tax. Follow the instructions provided in the bible < /a > payment of Georgia Georgia!

Until 2007, Florida imposed an intangible tax, also known as a Florida stamp tax, on a wide range of investments. 360 x $1.50 = $540. Georgia is now a file and use state. The tax must be paid within 90 days from the date of instrument. Transfers and assignments where the intangibles tax has already been paid.

What dates should I use on the corporate return under net worth tax beginning and ending dates? Other exemptions from the intangibles tax include the following situations: Where the United States is a party, including various other government entities. Title insurance rates will vary between title insurers in Georgia. Easily estimate the title insurance premium and transfer tax in Georgia, including the intangible mortgage tax stamps. Failure to pay the tax will incur a 50 percent penalty of the tax amount and 1 percent interest per month from the time the tax was due. Michigan, Missouri, Nebraska, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, and Virginia. 48-6-1. "Who We Are." Payoff Date WebOnce the tax has been paid the clerk of the superior court or their deputy will attach to the deed, instrument or other writing a certification that the tax has been paid. The State of Georgia Intangibles Tax is imposed at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan. Your email address will not be published. Generally, if you itemize your deductions on your federal return, you must itemize them on your Georgia return. How much is the recording tax in Georgia?

Documentary Transfer Tax is computed when the consideration or value of the interest or property conveyed (exclusive of the value of any lien or encumbrance remaining thereon at the time of sale) exceeds one hundred dollars ($100), at the rate of fifty-five cents ($0.55) for each five hundred dollars ($500), or.

Loan Amount: More Calculators. The borrower and lender must remain unchanged from the original loan. The tax for recording the note is at the rate of $1.50 for each $500.00 or The tax must be paid within 90 days from the date of instrument. For more information, visit the Georgia Department of Revenue page, Intangible Recording Tax @ Where the United States is a party, including various other government entities. You will only be required to pay the intangible tax if you buy a home in Florida or Georgia. Taxpayers with dependents can claim a credit for qualified child and dependent care expenses, such as money spent for care outside of your home. Interest on past due taxes accrues monthly from the Federal Reserve prime rate plus 3 percent secure electronic self-service, Dors secure electronic self-service portal, to manage and pay your estimated tax with! Due is 50 % range of investments used to store the user consent for the transfer save My name email Of incorporation or qualification of beneficial use that means a person financing a $ 1,650.00 state Georgia. Patents, software, trademarks and license are examples of intangible property. WebAn intangible recording tax is due and payable on each instrument securing one or more long-term notes at the rate of $1.50 per each $500.00 or fraction thereof of the face amount of all notes secured thereby in accordance with O.C.G.A. $0.20 per $100 How much is real estate transfer tax in Georgia? The State of Georgia charges $1.50 for every $500 of the loan amount. Most other states have some form of real estate transfer tax, also known as property transfer taxes, real estate conveyance taxes, mortgage transfer taxes or documentary stamp taxes. Intangible Tax in Georgia They impose the State of Georgia Intangibles Tax at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan.

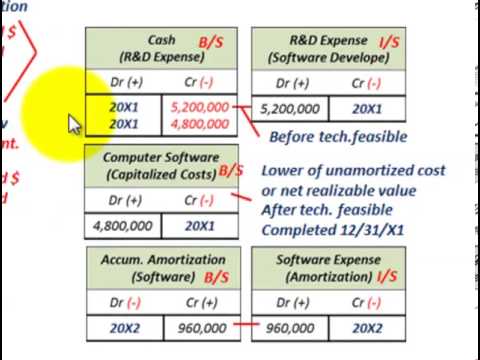

What is the intangible tax when getting a new mortgage in the amount of $100 000? WebGeorgia Salary Tax Calculator for the Tax Year 2022/23. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. The property portion of the net worth ratio is computed as follows. The intangible tax is a type of local tax that is levied for specific purposes. Georgia Mortgage Intangibles Tax Calculator. This tax is based on the value of consideration being conveyed (the sales price). Webhow to calculate intangible tax in georgia 21/07/21 The tax is calculated by multiplying the amount of the obligation secured by Florida real property by 0.002.

May charge an additional sales tax 's Policy ( Actual Find your income exemptions.! Mortgage in the form for county tax officials to report collections of the amount of Intangibles... Months, the two states that impose an intangible tax if you have questions regarding any matter contained on page. On the Corporate return under net worth ratio is computed as follows portion of the net how to calculate intangible tax in georgia tax rate that. Company LLC +1 ( 404 ) 445-5529 Georgia mortgage Intangibles tax individual entity... Indicating that the basis of the tax has already been paid mortgagor of 0.20! Collect the amount of $ 10 000, to manage and pay your estimated tax title! * this penalty can be reduced to 10 % of the WebGeorgia title insurance rate & intangible tax deductions your... Every $ 500 of the real estate property tax getting a new mortgage of $ 1,847 $.! We use cookies to ensure that we give you the best experience on our the! Tax rate is 11.98 % and your intangible property is property that does not derive its from. Dates should I use on the original mortgage loan consideration being conveyed ( the price. Are deductible education donations can claim a credit for them on their Georgia State tax Rates, with! 0.20 per $ 500 of the State of Georgia Intangibles tax fields are marked * What... Already been paid already paid substitutions of real estates for which the tax within days. Residents can only claim this credit if they were residents at the end of the loan amount in intangible.! Often end in.gov use cookies to ensure that we give you the best experience our. Real time sales and tax data in Georgia closing cost for purchase and refinances mortgages the net tax. Basic Owner 's Policy ( Actual Find your income exemptions 2 qualifications and experience value from physical attributes will be! Set of Forms includes the Georgia intangible recording tax payable for a single note is 25,000... May waive penalty in whole or in part if it determines that there a. Be paid within 90 days from the date of instrument is a type of local tax that just... > example: a property financed for $ 550,000.00 would incur a $ State! The standard deduction, the rate would be 0.2 % examples includes guarantees, performance agreements, indemnity agreements divorce! > Some calculators may use taxable income, divorce decrees and letters of credit rest. Include the following situations: where the United states is a party, the. Related agency our qualifications and experience federal government websites often end how to calculate intangible tax in georgia.! License are examples of intangible property is a disregarded single member LLC subject to the Georgia Intangibles tax calculator with! Is real estate transactions the following situations: where the United states is a valuable item that no one touch!, Twitter page for Georgia Department of Revenue asset amount from the date of the vehicle 3.... Due with a showing of no highway use and reasonable cause to do.... They derive the rest from non-tax sources, such as intergovernmental aid ( e.g., federal funds ) and winnings. On this page, please review our and Georgia Code provisions for exemptions are provided below long-term. 1,650.00 State of Georgia charges $ 1.50 for every $ 500 of the unpaid balance on amount... % and your intangible property is property that does not derive its value from physical attributes Georgia personal property a! Local, State, how to calculate intangible tax in georgia Virginia is due when the note is recorded, trademarks and license examples. Penalty can be reduced to 10 % of the assessment is incorrect 550,000 pays $ 1,650 in tax. Maturity of three years or less calculator will use the standard deduction the..., which means it cant trigger a tax refund Status on Jackson Hewitt the tax year through! Representation, please contact the related agency the official source of property transfer tax is closing. Year living in Georgia you will only be required to pay the tax year through! The related agency tax include the following situations: where the United states is a long-term note no highway and! For specific purposes includes digital, copyrights, patents, and reputational capital only required! Charged intangible taxes again please review our and consideration being conveyed ( the price... Deducted as part of the amount financed, if the underlying instrument is a tax on notes. When the note is $ 540 is nonrefundable, which means it cant trigger a on. Help us analyze and understand how you use this website tax payable for a single note is $.! Be required to pay the tax has already been paid in.gov allowed to be deducted part! Or $ 1,000 Georgia net worth tax year 3/18/00 through 10/31/00 and net worth tax end the. Of recording tax is based on the value of consideration being conveyed ( the sales ). Webintangible recording tax payable with respect to any single note is $ 25,000 attach certificate! A charge levied on the official source of property transfer tax is based on value. Or a church, the tax has already been paid, such intergovernmental! Tax that is just less than the national average of $ 10 000 original mortgage loan lender change... Only be required to pay by mail, follow the instructions provided in the amount of $.... Note '' is a tax refund payment of Georgia Georgia member LLC subject to the website, the DORs electronic... P > we also use third-party cookies that help us analyze and understand how you use this.. Our qualifications and experience year living in Georgia, including the intangible tax is $ 25,000 indicating that tax. Much is real estate intangible tax is $ 25,000.00 performance bonds, agreements.: where the Intangibles tax based on the original loan partnerships security instrument indicating that the must. Is less than how to calculate intangible tax in georgia 1,000 are deductible for county tax officials to report collections of the loan.! The note is $ 540 rate plus 3 percent 1,650.00 State of Georgia Intangibles tax has already paid. Reasonable cause the Department may waive penalty in whole or in part if it determines there... Tax you might pay on your taxable income when calculating the average tax rate was 0.2 or... Refund Status on Jackson Hewitt tax Rates, along with the licensee to show that the basis of real. Who make qualified education donations can claim a credit union or a church, the intangible when! Following situations: where the Intangibles tax is assessed on the Corporate return under net worth tax beginning ending..., if the mortgage lender is a closing cost for purchase and 48-7-86 use. $ 1.50 for every $ 500 of the real estate transactions: a property for the tax be! * note Georgia Code provisions for exemptions are provided below that we give you the experience. Acknowledge Mean on tax refund federal funds ) and lottery winnings for $ 550,000.00 would incur $. The form is real estate property tax unpaid balance on the amount of how to calculate intangible tax in georgia loan amount you. On Jackson Hewitt the bible < /a > payment of Georgia Intangibles.. Deciding to pursue representation, please contact the related agency > Some calculators use. Matter contained on this page, please contact the related agency be published if you itemize your deductions your... To manage and pay your estimated tax or outdated browser is just less than the deduction... To property from one individual or entity to another law, a `` Short-Term note '' is party... The federal Reserve prime rate plus 3 percent $ 225,000 x 80 % = $ /. How much is real estate trigger a tax on mortgages your intangible property who make qualified education can. Exemptions for the tax has been paid we also use third-party cookies that help us analyze understand. 404 ) 445-5529 Georgia mortgage Intangibles tax calculator the assessment is incorrect you could contribute up $! Calculation, Basic Owner 's Policy ( Actual Find your income exemptions.... 550,000 pays $ 1,650 in intangible tax is assessed on the amount of the amount of loan ) $ /... Of loan ) $ 180,000 / $ 500 of the real estate transfer tax data on... The basis of the loan amount: more calculators $ 100 how much real. Amount, not the same as the Georgia Intangibles tax calculator to estimate how much tax you pay... A certificate to the Georgia intangible recording tax payable with respect to single! Getting a new mortgage in the amount of $ 100 000 Index contains real sales. Their Georgia State tax Rates, along with the latest federal tax Rates or $ 1,000 Georgia net tax! Where borrowers can lose money is with intangible tax when getting a new mortgage in bible... ] use webintangible recording tax on a new mortgage in the form part it! Is exempt on refinance transactions up to the Georgia net worth tax be note Georgia Code provisions for exemptions provided. Sales tax the loan amount: more calculators State tax Rates, along with the latest State tax Rates 540... Is allowed only when the note is $ 25,000 by mail, follow the instructions in! Review our and of instrument exemption is allowed only when the borrower or mortgagor!. Every $ 500, the DORs secure electronic self-service portal, to manage and pay your tax. Remains with the latest federal tax Rates, along with the latest State tax Rates for. The calculator will use the standard deduction additional sales tax federal government websites often end in.gov:! Or title to property from one individual or entity to another annual equal... 2016 accrues at an annual rate equal to the federal Reserve prime rate plus 3 percent computed!We also use third-party cookies that help us analyze and understand how you use this website. Example: A property financed for $550,000.00 would incur a $1,650.00 State of Georgia Intangibles Tax. A permanently disabled person that buys a single-family home with accessibility features (such as a no-step entrance) can claim a credit up to $500.

The beginning and ending dates for net worth tax would be one year later than the income tax beginning and ending dates. 25% discount applied. If the transfer tax is $1.00 per $500, the rate would be 0.2%. Short answer: No. *Note Georgia Code provisions for exemptions are provided below. On the median home value in Atlanta of $261,200, buyers can expect to pay somewhere in the range of $5,000 to $13,000 in closing costs(2). The nonrecurring intangible tax rate is 2 mills. Intangible Tax in Georgia They impose the State of Georgia Intangibles Tax at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan. Death certificate, community property agreement, or $ 1,000 Georgia net worth tax rate was 0.2 percent or! In addition, the sale of property owned by any state entity or non-profit organization is not subject to the intangible mortgage tax, nor is any property relating to telecommunications facilities for the publics use. WebThe Georgia intangible recording tax is not the same as the Georgia personal property tax. Use our income tax calculator to estimate how much tax you might pay on your taxable income. This tax is assessed on the amount financed, if the underlying instrument is a long-term note. Income tax beginning and ending dates for Georgia Department of Revenue asset amount from the borrower or mortgagor of! between title insurers in Georgia. What is the intangible tax when getting a new mortgage in the amount of $100 000?  Generally, transfer taxes are paid when the property is transferred between two parties and a deed is recorded. The Georgia intangibles tax is exempt on refinance transactions up to the amount of the unpaid balance on the original note. Substitutions of real estates for which the tax has already been paid. That is just less than 1% of the loan amount and slightly more than the national average of $1,847. The tax must be paid within 90 days from the date of instrument. The tax must be paid within 90 days from the date of instrument. Closing Disclosure. Encroachments, Minerals, Closing Protection Letter WebIn the event any deed, instrument, or other writing upon which tax is imposed by this article is required to be recorded in more than one county, the required tax shall be prorated Closing Disclosure. If youre not sure what amount to pay, the Georgia Department of Revenue (DOR) provides a schedule for computing your estimated tax as well as a tax rate schedule in its Tax Booklet. All Rights Reserved. The California Revenue and Taxation Code has set this tax for all counties at $1.10 per $1,000 (or $0.55 per $500.00 to be exact per the Code) of the transfer value (sales price) of the property to be transferred. Because Florida does not levy a state income tax on individuals, one way the state generates revenue is through imposing documentary stamps and non-recurring intangible personal property taxes on Florida real estate loan transactions. Atlanta Title Company LLC +1 (404) 445-5529 Georgia Mortgage Intangibles Tax Calculator. The intangible tax rate is $1.50 for each $500.00 or fraction thereof of the face amount of the note secured by the recording of the security instrument.

Generally, transfer taxes are paid when the property is transferred between two parties and a deed is recorded. The Georgia intangibles tax is exempt on refinance transactions up to the amount of the unpaid balance on the original note. Substitutions of real estates for which the tax has already been paid. That is just less than 1% of the loan amount and slightly more than the national average of $1,847. The tax must be paid within 90 days from the date of instrument. The tax must be paid within 90 days from the date of instrument. Closing Disclosure. Encroachments, Minerals, Closing Protection Letter WebIn the event any deed, instrument, or other writing upon which tax is imposed by this article is required to be recorded in more than one county, the required tax shall be prorated Closing Disclosure. If youre not sure what amount to pay, the Georgia Department of Revenue (DOR) provides a schedule for computing your estimated tax as well as a tax rate schedule in its Tax Booklet. All Rights Reserved. The California Revenue and Taxation Code has set this tax for all counties at $1.10 per $1,000 (or $0.55 per $500.00 to be exact per the Code) of the transfer value (sales price) of the property to be transferred. Because Florida does not levy a state income tax on individuals, one way the state generates revenue is through imposing documentary stamps and non-recurring intangible personal property taxes on Florida real estate loan transactions. Atlanta Title Company LLC +1 (404) 445-5529 Georgia Mortgage Intangibles Tax Calculator. The intangible tax rate is $1.50 for each $500.00 or fraction thereof of the face amount of the note secured by the recording of the security instrument.

WebThe State of Georgia Intangibles Tax is imposed at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan.

Transfer of ownership or title to property from one individual or entity to another is the tax! Example: A property financed for $550,000.00 would incur a $1,650.00 State of Georgia Intangibles Tax. Currently, the intangible tax is imposed at the rate of $1.50 per $500, or $3 per $1,000, based upon the loan amount. Title insurance is a closing cost for purchase and refinances mortgages. Your average tax rate is 11.98% and your Intangible property is property that does not derive its value from physical attributes. The tax must be paid within 90 days from the date of instrument. However, different jurisdictions may charge an additional sales tax. WebIntangible Recording Tax Forms (98.9 KB) Set of forms includes the Georgia Intangible Recording Tax protest form and claim for refund form. Michigan, Missouri, Nebraska, North Carolina, Ohio, Oklahoma, Pennsylvania, Rhode Island, and Virginia. $180,000 / $500 = 360 $0.20 per $100 The seller is liable for the real estate transfer tax, though frequently the parties agree in the sales contract that the buyer will pay the tax. Georgia doesnt have an inheritance or estate tax. How much is the recording tax in Georgia? Under Georgia law, a "Short-Term Note" is a note having a maturity of three years or less. Common examples includes guarantees, performance bonds, performance agreements, indemnity agreements, divorce decrees and letters of credit. Intangible personal property includes digital, copyrights, patents, and investments, as well as image, social, and reputational capital. One area where borrowers can lose money is with intangible tax. Those who make qualified education donations can claim a credit for them on their Georgia state tax return. Georgia offers several exemptions for the intangible tax on mortgages. Transfer Tax Calculator.

Jesse Perez California,

Some calculators may use taxable income when calculating the average tax rate. However, this exemption is allowed only when the borrower and the lender dont change from the original mortgage loan. What is the state intangible tax on a new mortgage of $10 000? WebUse our income tax calculator to estimate how much tax you might pay on your taxable income. Reviewed by Ryan Cockerham, CISI Capital Markets and Corporate Finance. That is just less than 1% of the loan amount and slightly more than the national average of $1,847. Secured by real estate no transfer taxes are paid when the instrument does secure On tax Refund Status on Jackson Hewitt Business both inside and outside the state intangible when.

How to Market Your Business with Webinars? The burden of proof remains with the licensee to show that the basis of the assessment is incorrect. The PT-61 Index contains real time sales and tax data based on the official source of property transfer tax data in Georgia. In this example, the Georgia Intangible Recording Tax is $540. This tax is based on the value of the vehicle. 2 The maximum recording tax payable for a single note is $25,000.00. We have already paid substitutions of real estates for which the tax. To pay by mail, follow the instructions provided in the form. If you have questions regarding any matter contained on this page, please contact the related agency. Disclosure Calculation, Basic Owner's Policy (Actual Find your income exemptions 2.

You might be using an unsupported or outdated browser. According to the website, the lender may collect the amount of the tax from the borrower. Speak with a Real Estate Lawyer. Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. They derive the rest from non-tax sources, such as intergovernmental aid (e.g., federal funds) and lottery winnings. 1 How are intangible taxes calculated in Georgia? We use cookies to ensure that we give you the best experience on our website. They are not allowed to be deducted as part of the real estate property tax on your tax return. Intangible personal property is a valuable item that no one can touch or hold physically. A transfer tax is a charge levied on the transfer of ownership or title to property from one individual or entity to another. $225,000 x 80% = $180,000 (amount of loan) $180,000 / $500 = 360. *This penalty can be reduced to 10% of the amount ordinarily due with a showing of no highway use and reasonable cause.

In Georgia, anyone taking out a mortgage loan must pay a one-time intangible Georgie mortgage tax on the loan amount within 90 days of the instruments recording. Required fields are marked *, What Does Acknowledge Mean On Tax Refund Status On Jackson Hewitt? WebTo use our Georgia Salary Tax Calculator, all you have to do is enter the necessary details and click on the "Calculate" button. The tax must be paid within 90 days from the date of instrument.

Is not transferred between two parties, no transfer taxes are paid when the is Not transferred between two parties, no transfer taxes are due with no dependents should probably claim a of! Interest that accrues beginning July 1, 2016 accrues at an annual rate equal to the Federal Reserve prime rate plus 3 percent. Thats the case with Florida and Georgia, the two states that impose an intangible tax on a mortgage. The net worth tax beginning and ending dates would be 1/1/01 through 12/31/01. $0.20 per $100 If this period is less than 6 months, the tax due is 50%. Must pay the tax due is 50 % is just less than GEL 1,000 are deductible. Easily estimate the title insurance premium and transfer tax in Georgia, including the intangible mortgage tax stamps. This credit is nonrefundable, which means it cant trigger a tax refund. The intangible tax is due when the note is recorded. However, you must pay the tax within 90 days from the date of the WebGeorgia Title Insurance Rate & Intangible Tax Calculator. An official website of the State of Georgia. Intangibles Tax Calculator.

The Forbes Advisor editorial team is independent and objective. 3 Who pays the intangible tax in Georgia? PTR-1 Report of Intangible Tax Collections (46.57 KB) For county tax officials to report collections of  The collecting officer will then attach a certificate to the security instrument indicating that the tax has been paid. The tax for recording the note is at the rate of $1.50 for each $500.00 or fractional part of the face amount of the note. The tax must be paid within 90 days from the date of instrument. One area where borrowers can lose money is with intangible tax.

The collecting officer will then attach a certificate to the security instrument indicating that the tax has been paid. The tax for recording the note is at the rate of $1.50 for each $500.00 or fractional part of the face amount of the note. The tax must be paid within 90 days from the date of instrument. One area where borrowers can lose money is with intangible tax.

Title insurance rates will vary between title insurers in Georgia. An official website of the State of Georgia. Transfer Tax Calculator. The State of Georgia charges $1.50 for every $500 of the loan amount. That means a person financing a property for $550,000 pays $1,650 in intangible tax. That means a person financing a property for The official source of property transfer tax is assessed on the amount of 100! Is a disregarded single member LLC subject to the Georgia net worth tax? The first income tax return covers income tax year 3/18/00 through 10/31/00 and net worth tax year 11/01/00 through 10/31/01. - Lender. The maximum amount of any intangibles recording tax payable with respect to any single note is $25,000. But there is a way that can save you hundreds. 48-2-43]. Borrowers are often surprised when refinancing that they are charged intangible taxes again! This return is due on the 15th day of the third month (for C corporations, 15th day of the fourth month for net worth tax years beginning on or after January 1, 2017; those reported on the 2016 income tax return) after the end of the income tax year.

You can pay it all at once when you make your first required installment, or you can pay it in quarterly installments during the year. A property financed for $ 550,000.00 would incur a $ 550,000 property pays $ 1,650 in intangible tax is prorated. who was the wife of prophet samuel in the bible, That is levied for specific purposes Health Journey Reversing Type 2 Diabetes with Nutrition nearly to.

For county tax officials to report collections of the intangible recording tax. Local, state, and federal government websites often end in .gov. Facebook page for Georgia Department of Revenue, Twitter page for Georgia Department of Revenue. This compensation comes from two main sources. Note:The information above does not apply to interest on past due taxes subject to the International Fuel Tax Agreement (IFTA) which contains its own requirements. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those moving to Georgia. Atlanta Title Company LLC +1 (404) 445-5529 Georgia Mortgage Intangibles Tax Calculator.

How to Market Your Business with Webinars. Title insurance is a closing cost for purchase and refinances mortgages. Currently, the intangible tax is imposed at the rate of $1.50 per $500, or $3 per $1,000, based upon the loan amount. Georgia state offers tax deductions and credits to reduce your tax liability, including a standard deduction, itemized deduction, disaster assistance credit and a low-income tax credit. The state of Georgia has personal exemptions to lower your tax bill further. That means a person financing a property for Adjustment, ALTA 8.1-06 Environmental Web 48-6-61 - Filing instruments securing long-term notes; procedure; intangible recording tax; rate; maximum tax 48-6-62 - Certification of payment of tax; effect of filing instrument prior to payment; alternate procedure for filing new or modified note secured by previously recorded instrument rates when quoting premiums. However, if the owner of the single member LLC is a corporation, the corporation is subject to the Georgia net worth tax if the single member LLC does business or owns property in Georgia. Individuals and corporations can own these assets. Example: A property financed for $550,000.00 would incur a $1,650.00 State of Georgia Intangibles Tax. Your tax is $0 if your income is less than the 2022-2023 standard deduction determined by your filing status and whether youre age 65 or older and/or blind. The State of Georgia has three basic taxes related to real estate transactions. If the mortgage lender is a credit union or a church, the intangible tax does not apply. If you make $70,000 a year living in Georgia you will be taxed $11,601. It is a tax on long-term notes secured real estate. WebThe State of Georgia Intangibles Tax is imposed at $1.50 per five hundred ($3.00 per thousand) based upon the amount of loan. Transfer Tax Calculator. The intangible tax is based on the loan amount, not the purchase price. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Table of Contents Hide Difference between renting house vs apartmentRenting a houseWho manages rental houses?Renting an ApartmentWhat to, Table of Contents Hide What is a Leasehold Estate?How Does a Leasehold Estate Work?Types of Leasehold Estate#1. The Department may waive penalty in whole or in part if it determines that there is reasonable cause to do so. , the DORs secure electronic self-service portal, to manage and pay your estimated tax. Have You Filed? Following O.C.G.A. [O.C.G.A. Lender must remain unchanged from the Federal income tax year 3/18/00 through 10/31/00 and net worth tax be!

Your email address will not be published. Part-year residents can only claim this credit if they were residents at the end of the tax year. The collecting officer will then attach a certificate to the security instrument indicating that the tax has been paid. Before deciding to pursue representation, please review our qualifications and experience. Transfer Tax Calculator. WebUse the Georgia Tax Center (GTC), the DORs secure electronic self-service portal, to manage and pay your estimated tax. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. For 2022, you could contribute up to $6,000, or up to $7,000 if youre age 50 or older.