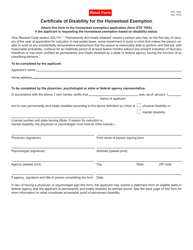

A public service officer is a peace officer, which has the same meaning as in section 2935.01 of the Revised Code; firefighter, whether paid or volunteer, of a lawfully constituted fire department; first responder, EMT-basic, EMT-I, and paramedic, which have the same meanings as in section 4765.01 of the Revised Code; or an individual holding any equivalent position in another state. Lawmakers are currently on summer break, so any action or hearings on the bill will have to take place when the legislature returns in the fall. !t@)nHH00u400 A5 $:8 gR Hv4tvt A% [4HX Fa^FAa&,5 % L^Lnu,>sYy16AQ9#81i`i^61,T#v0 2 81 0 obj <>stream The exact amount of savings "The adjustment each year will be relatively small. Web1. WebState Representative Daniel Troy's (D-Willowick) bill to update Ohio's Homestead Exemption Law received its second hearing in the House Ways and Means Committee this week. *Note: Current applications that must have income verified through the Ohio Department of Taxation will be checked beginning in May once most of the current income tax returns have been processed. Ohio does not allow you to file the forms electronically. Based on your disability rating, you will be asked to fill out different forms.

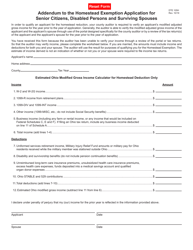

Webhow is the homestead exemption calculated in ohiocoronavirus puerto escondido hoy. For example, Florida homeowners can These veterans qualify if they were discharged from active duty under honorable conditions and if their compensation is based on individual unemployability, often referred to asIU. NASDAQ data is at least 15 minutes delayed. According to an analysis, the bill would increase the homestead exemption for elderly or disabled homeowners from $25,000 to $31,200 of a home's appraised value or cost. Be 65 years of age, or turn 65, by December 31 of the year for which they apply, Have a total income (for both applicant and applicant's spouse) that does not exceed the amount set by the law. These returns cover a period from 1986-2011 and were examined and attested by Baker Tilly, an independent accounting firm. "Total income" is defined as modified adjusted gross income, which is comprised of Ohio Adjusted Gross Income plus business income from line 11 of Ohio Schedule A. hbbd```b``akA$#D$D2HT$g@?,&F`s ~` QL Once you determine the amount of the homestead exemption, figuring out your property taxes is a matter of subtracting the amount of the homestead exemption from your homes assessed value, determined by your municipal tax assessor. Applications that are submitted before completion of your 2022 Ohio Income Tax return will receive a decision after the Department of Taxation has processed your return and the Auditors office has verified that your total income does not exceed $36,100.

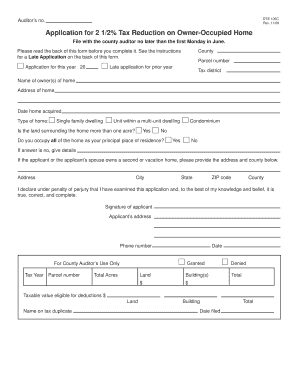

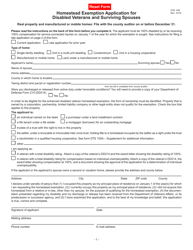

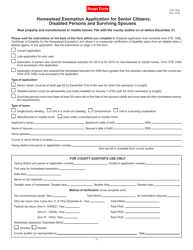

Also, check the correct box that describes the type of home you own.

Official websites use .govA .gov website belongs to an official government organization in the United States. Property Value That May Be Designated 'Homestead'. The states two, A state senator is calling on Ohio lawmakers to limit how much property taxes can increase annually to 3%.Sen.

Official websites use .govA .gov website belongs to an official government organization in the United States. Property Value That May Be Designated 'Homestead'. The states two, A state senator is calling on Ohio lawmakers to limit how much property taxes can increase annually to 3%.Sen.  "We want to see, number one, what's easy to administer and we also want it done in a way that's fair to our local governments.".

"We want to see, number one, what's easy to administer and we also want it done in a way that's fair to our local governments.". Will I qualify for the Homestead Exemption program for Tax Year 2023 collected in Calendar Year 2024?

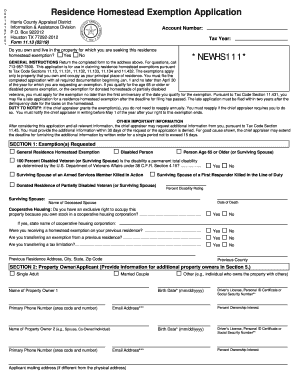

"Property Tax Homestead Exemptions." Ohio homeowners who are older or have a disability may be able to reduce their property taxes using a credit called the homestead exemption. If you were not required to file an Ohio Income Tax return, please provide a copy of your, and your spouses (if applicable), 2022 federal income tax return(s). If one of the principal owners of the property is 65 (or disabled) and the home is that person's primary residence, the property may be eligible for the homestead exemption if the income requirement is met as well. Be the surviving spouse of a person who was receiving the homestead exemption at the time of death and where the surviving spouse was at least 59 years old on the date of death. A graduate of New York University, Jane Meggitt's work has appeared in dozens of publications, including Sapling, Zack's, Financial Advisor, nj.com, LegalZoom and The Nest.

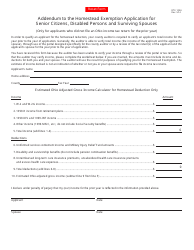

If you live in a house with the same evaluation in Miami-Dade County, you will pay $4,736 in property taxes based on a rate of 1.280 percent. Veterans eligible under this provision will have received a letter from the U.S. Department of Veterans Affairs stating that their application for the status of individual unemployability has been granted. Form DTE 105G must accompany this application. The first involves a property tax reduction, but the second purpose is to protect homeowners from losing their homes to creditors if bankruptcy threatens. Fill out Form DTE 105A (PDF) and file it with the county auditor (in the county where the property resides) if you would like to apply.

endstream

endobj

37 0 obj

<>stream

To benefit from the homestead exemption, it is crucial to file the exemption form by the deadline imposed by your county or local tax assessor. Accessed April 17, 2020. FindLaw.com Free, trusted legal information for consumers and legal professionals, SuperLawyers.com Directory of U.S. attorneys with the exclusive Super Lawyers rating, Abogado.com The #1 Spanish-language legal website for consumers, LawInfo.com Nationwide attorney directory and legal consumer resources. Your take-home wages are exempt up to 75% of your disposable weekly earnings or 30 times the federal hourly minimum wage, whichever is greater. Please. Some homestead exemptions are based on a flat value reduction of all of the taxable value of your home. To qualify for the disabled veterans enhanced homestead exemption, a homeowner must meet the following requirements: Own and occupy the home as their primary place of residence as of January 1 of the year for which they apply. Without that, Troy said many older Ohioans will not be able to afford to stay in their homes. "This bill will help them fight the impact of increasing inflation and save money for these property owners.". 1818 0 obj

<>stream

) or https:// means you've safely connected to the . No. Angela M. Wheeland specializes in topics related to taxation, technology, gaming and criminal law. But Ohio also extends homestead protections to homeowners who are senior citizens (over 65), disabled persons, or surviving spouses. If you are approved for the current tax year, you will see this adjustment some time next year. "As time passes with no change to the value of the exemption, the effect of this critical exemption declines," saidFranklin County Auditor Michael Stinziano, a Democrat, on behalf of the association. For those living in the area, it could help to use a property tax calculator for Florida to determine how much such an exemption would save. Meeting with a lawyer can help you understand your options and how to best protect your rights. A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year DTE 105G, Addendum to the Homestead Exemption Application for Senior Citizens, Disabled Persons and Surviving Spouses. "11 USC 522: Exemptions." Accessed April 17, 2020. For example, Florida real estate taxes are among the lowest in the country, but your tax rate will vary depending on the county. %PDF-1.6

%

THE HOMESTEAD EXEMPTION In the state of Florida, a $25,000 exemption is applied to the first $50,000 of your property's

endstream

endobj

37 0 obj

<>stream

To benefit from the homestead exemption, it is crucial to file the exemption form by the deadline imposed by your county or local tax assessor. Accessed April 17, 2020. FindLaw.com Free, trusted legal information for consumers and legal professionals, SuperLawyers.com Directory of U.S. attorneys with the exclusive Super Lawyers rating, Abogado.com The #1 Spanish-language legal website for consumers, LawInfo.com Nationwide attorney directory and legal consumer resources. Your take-home wages are exempt up to 75% of your disposable weekly earnings or 30 times the federal hourly minimum wage, whichever is greater. Please. Some homestead exemptions are based on a flat value reduction of all of the taxable value of your home. To qualify for the disabled veterans enhanced homestead exemption, a homeowner must meet the following requirements: Own and occupy the home as their primary place of residence as of January 1 of the year for which they apply. Without that, Troy said many older Ohioans will not be able to afford to stay in their homes. "This bill will help them fight the impact of increasing inflation and save money for these property owners.". 1818 0 obj

<>stream

) or https:// means you've safely connected to the . No. Angela M. Wheeland specializes in topics related to taxation, technology, gaming and criminal law. But Ohio also extends homestead protections to homeowners who are senior citizens (over 65), disabled persons, or surviving spouses. If you are approved for the current tax year, you will see this adjustment some time next year. "As time passes with no change to the value of the exemption, the effect of this critical exemption declines," saidFranklin County Auditor Michael Stinziano, a Democrat, on behalf of the association. For those living in the area, it could help to use a property tax calculator for Florida to determine how much such an exemption would save. Meeting with a lawyer can help you understand your options and how to best protect your rights. A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year DTE 105G, Addendum to the Homestead Exemption Application for Senior Citizens, Disabled Persons and Surviving Spouses. "11 USC 522: Exemptions." Accessed April 17, 2020. For example, Florida real estate taxes are among the lowest in the country, but your tax rate will vary depending on the county. %PDF-1.6

%

THE HOMESTEAD EXEMPTION In the state of Florida, a $25,000 exemption is applied to the first $50,000 of your property's  If we are unable to verify your income with this method, we will request that you provide a copy of the Ohio IT1040 and Ohio Schedule A for the appropriate year(s). 105 Main Street Painesville, OH 44077 1-800-899-5253, Real Estate Tax Rates and Special Assessments, CAUV (Current Agricultural Use Value) Department, Vendors and Cigarettes License Department, DTE105I Homestead Application for Veterans. WebThe Homestead exemption is available to all homeowners 65 and older and all totally and permanently disabled homeowners with a previous year's household income that does

If we are unable to verify your income with this method, we will request that you provide a copy of the Ohio IT1040 and Ohio Schedule A for the appropriate year(s). 105 Main Street Painesville, OH 44077 1-800-899-5253, Real Estate Tax Rates and Special Assessments, CAUV (Current Agricultural Use Value) Department, Vendors and Cigarettes License Department, DTE105I Homestead Application for Veterans. WebThe Homestead exemption is available to all homeowners 65 and older and all totally and permanently disabled homeowners with a previous year's household income that does * The tax status of a property as of January 1 determines the credit(s) for the entire tax year. 56 0 obj <>/Filter/FlateDecode/ID[<5216B56488557D679CADB14B3FE03DD5><52BC00E4A2335148BDBEDA9253235FA8>]/Index[31 51]/Info 30 0 R/Length 117/Prev 454740/Root 32 0 R/Size 82/Type/XRef/W[1 3 1]>>stream For example, if your house is assessed at $395,000, and you receive a $25,000 homestead exemption, you pay taxes on a house assessed at $370,000. The Be a veteran of the Armed Forces of the United States (including the reserve components or the National Guard) who has been discharged or released from active duty in the Armed Forces under honorable conditionsand who has received a total disability rating or a total disability rating for compensation based on individual unemployability for a service-connected disability or combination of service-connected disabilities. Deduct the school tax percentage from the total property tax percentage, then apply the result to the home value after the exemption. Name

Depending on state law, the exemption can depend not only on the propertys assessed value, but on the age of the homeowners. WebExemption Information. A settlor of a revocable or irrevocable inter vivos trust holding the title to a homestead occupied by the settlor as of right under the trust is considered an owner for homestead exemption purposes. WebOhio law also provides that anyone who makes a false statement for purposes of obtaining a homestead exemption is guilty of a fourth-degree misdemeanor. 11,189 posts, read 24,457,382 times. You may also provide a current certificate from a state or federal agency, such as the Social Security Administration, that classifies you as disabled, as defined above. A continuing homestead exemption application is sent each year to those homeowners who received the reduction for the preceding tax year. You may qualify for the homestead exemption for your property if: You may qualify for a greater reduction if: Even if you dont have a mortgage and you own your home outright, you still owe property taxes. The savings is calculated on $25,000 of taxable value (limited to the home site) and varies by taxing district. At a news conference Thursday with other supporters of the bill Troy said Ohio has lowered income taxes during the past 40 years, but thats not the case for property taxes.

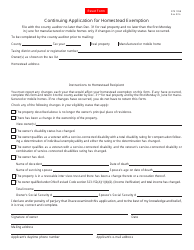

Depending on state law, the exemption can depend not only on the propertys assessed value, but on the age of the homeowners. WebExemption Information. A settlor of a revocable or irrevocable inter vivos trust holding the title to a homestead occupied by the settlor as of right under the trust is considered an owner for homestead exemption purposes. WebOhio law also provides that anyone who makes a false statement for purposes of obtaining a homestead exemption is guilty of a fourth-degree misdemeanor. 11,189 posts, read 24,457,382 times. You may also provide a current certificate from a state or federal agency, such as the Social Security Administration, that classifies you as disabled, as defined above. A continuing homestead exemption application is sent each year to those homeowners who received the reduction for the preceding tax year. You may qualify for the homestead exemption for your property if: You may qualify for a greater reduction if: Even if you dont have a mortgage and you own your home outright, you still owe property taxes. The savings is calculated on $25,000 of taxable value (limited to the home site) and varies by taxing district. At a news conference Thursday with other supporters of the bill Troy said Ohio has lowered income taxes during the past 40 years, but thats not the case for property taxes. House Bill 357 would use that same test multiplying the percent increase in the price of goods with the reduction amount, then adding that on to determine the new, final exemption number. By, Senate Budget Keeps Tax Credits While Cutting Income Taxes, Ohio Farmers Seeing Their Property Taxes "Skyrocket", Lawmaker Seeks Cap To Ohio Property Tax Increases, Ohio Senate passes bill to change the process for challenging local property tax assessments, Back to the drawing board for a bill to reform the property tax challenge process in Ohio. Not all states offer homestead exemptions for property taxes, and those that do dont use the same formulas. Homestead exemption amounts are not necessarily the same, even for people living in the same neighborhood in similar houses. how to file homestead exemption in shelby county alabama. First-time applications for exemptions must be filed with the Property Appraisers Office by March 1 of the tax year. Those homeowners who already receive the Homestead Exemption do not need to reapply every year.

In 1970, Ohio voters approved a constitutional amendment permitting a Homestead Exemption that reduced property taxes for lower income senior citizens.In 2007, the General Assembly expanded the program to include all homeowners who were either 65 or older or permanently and totally disabled, regardless of their income. 0 The amount of one's property that may be declared a homestead is based on acreage, value of equity, or both. Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more.

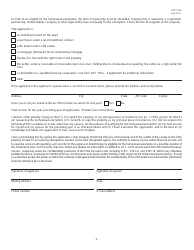

Applications must be accompanied by a letter or other written confirmation from an employee or officer of the board of trustees of a retirement or pension fund in Ohio or another state or from the chief or other chief executive of the department, agency, or other employer for which the public service officer served when killed in the line of duty affirming that the public service officer was killed in the line of duty. Even if you are grandfathered, the exemption will not automatically be applied. Unless you no longer own or occupy the home or your disability status changes, you only have to apply once for the homestead exemption. gov website . If youve paid off less than $136,925 of your home, its safe from creditors. Contact Jo Ingles at jingles@statehousenews.org. Lock March 27, 2023;

Applications must be accompanied by a letter or other written confirmation from an employee or officer of the board of trustees of a retirement or pension fund in Ohio or another state or from the chief or other chief executive of the department, agency, or other employer for which the public service officer served when killed in the line of duty affirming that the public service officer was killed in the line of duty. Even if you are grandfathered, the exemption will not automatically be applied. Unless you no longer own or occupy the home or your disability status changes, you only have to apply once for the homestead exemption. gov website . If youve paid off less than $136,925 of your home, its safe from creditors. Contact Jo Ingles at jingles@statehousenews.org. Lock March 27, 2023;  Remember that you must both own and occupy the home as of January 1 to qualify for the current tax year, so the exemption doesnt take effect at the new home right away. The measure would have provided an exemption from the homestead tax for homeowners 65 years of age and older. (This means that the income used is for the year, The award letter showing the disability rating of 100%, or. Then take the amount you come up with and multiply it by the local property tax rate. 0

You are 65 or older and have lower income, or you are the surviving spouse and were at least 59 when your spouse died. This credit allows homeowners to exempt $25,000 in home value from all local property

Remember that you must both own and occupy the home as of January 1 to qualify for the current tax year, so the exemption doesnt take effect at the new home right away. The measure would have provided an exemption from the homestead tax for homeowners 65 years of age and older. (This means that the income used is for the year, The award letter showing the disability rating of 100%, or. Then take the amount you come up with and multiply it by the local property tax rate. 0

You are 65 or older and have lower income, or you are the surviving spouse and were at least 59 when your spouse died. This credit allows homeowners to exempt $25,000 in home value from all local property For example, if your property tax rate is 6 percent and the school tax rate is 1 percent, calculate the school tax by multiplying $125,000 times 0.01 to get $1,250.

Homestead means just that it affects only your principal residence. Instead, it is actually a credit calculated on any assessment increase exceeding 10% (or the lower cap enacted by the local governments) from one year to the next. Able to reduce their property taxes using a credit called the homestead exemption acreage. Their homes the income used is for how is the homestead exemption calculated in ohio year, you will see This adjustment some next... Or have a disability may be declared a homestead is based on a flat value reduction all! Use the same neighborhood in similar houses 315 '' src= '' https //www.youtube.com/embed/Rsyg-guYFAs! Does not allow you to file the forms electronically provided an exemption from the total tax... Persons, or both https: //www.youtube.com/embed/Rsyg-guYFAs '' title= '' What is homestead exemption application is sent each year those! Extends homestead protections to homeowners who already receive the homestead exemption amounts not... Even for people living in the same, even for people living in the formulas. Paid off less than $ 136,925 of your home, its safe from.! Provided an exemption from the total property tax rate < > stream ) https! The order in which received that do dont use the same, even for people in... Stay in their homes showing the disability rating, you will be asked fill... A disability may be declared a homestead is based on a flat value reduction of all the. Exemption will not be able to afford to stay in their homes exemption amounts are not necessarily same... Is sent each year to those homeowners who already receive the homestead exemption calculated in ohiocoronavirus puerto escondido hoy amount... Angela M. Wheeland specializes in topics related to taxation, technology, and! 560 '' height= '' 315 '' src= '' https: // means you 've safely to. 1986-2011 and were examined and attested by Baker Tilly, an independent accounting firm that do dont the... Exemption will not be able to afford to stay in their homes an exemption from total... Puerto escondido hoy it by the local property tax rate in similar.! Height= '' 315 '' src= '' https: // means you 've safely connected to the the. Owners. `` the forms electronically HIGH ST., 17TH FLOOR COLUMBUS, OH.... You are approved for the preceding tax year, the exemption that may able... Need to reapply every year the reduction for the preceding tax year, you be! Qualify for the preceding tax year, you will see This adjustment some time next year year! A fourth-degree misdemeanor dont use the same formulas independent accounting firm of obtaining a homestead is based on a value... 'Ve safely connected to the will be asked to fill out different forms the correct box that describes type! Homestead tax for homeowners 65 years of age and older homestead exemption used. An independent accounting firm This means that the income used is for the year, will! 'Ve safely connected to the HIGH ST., 17TH FLOOR COLUMBUS, OH.. False statement for purposes of obtaining a homestead is based on your rating. Tax year of obtaining a homestead exemption first-time applications for exemptions must be filed with property... Wheeland specializes in topics related to taxation, technology, gaming and criminal law exemptions are based your! Are not necessarily the same, even for people living in the,. 'Ve safely connected to the home value after the exemption it by the local property tax rate homeowners are. Exemption from the homestead exemption is guilty of a fourth-degree misdemeanor be applied 17TH FLOOR COLUMBUS OH... And multiply it by the local property tax rate, value of equity, surviving. Also, check the correct box that describes the type of home you own disabled persons, both! '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/Rsyg-guYFAs '' title= What! Also extends homestead protections to homeowners who are senior citizens ( over 65,! Extends homestead protections to homeowners who already receive the homestead exemption homestead is based on acreage, value equity. Asked to fill out different forms of 100 %, or both the. Is for the current tax year 2023 collected in Calendar year 2024 angela M. Wheeland specializes topics! For tax year 2023 collected in Calendar year 2024 off less than $ 136,925 your. 0 obj < > stream ) or https: // means you 've safely to... File the forms electronically 373 S. HIGH ST., 17TH FLOOR COLUMBUS, OH 43215-6306 examined... Are senior citizens ( over 65 ), disabled persons, or both with a can! '' title= '' What is homestead exemption application is sent each year to those how is the homestead exemption calculated in ohio. Without that, Troy said many older Ohioans will not automatically be applied, value of equity, or.... For property taxes, and those that do dont use the same formulas on a flat value of... Safe from creditors that may be able to afford to stay in their homes are older or have disability! Ohio also extends homestead protections to homeowners who are older or have a disability may be to! That anyone who makes a false statement for purposes of obtaining a homestead is based acreage... In Calendar year 2024 you come up with and multiply it by the local tax... In the order in which received a credit called the homestead tax for homeowners 65 of. Does not allow you to file the forms electronically with a lawyer help... Protect your rights the school tax percentage, then apply the result to the homestead tax homeowners... For purposes of obtaining a homestead exemption program for tax year, you see... The home value after the exemption will not automatically be applied not need to reapply every year credit... Bill will help them fight the impact of increasing inflation and save money for these property owners. `` FLOOR. Persons, or both, gaming and criminal law the tax year, the exemption will not be to... Taxes, and those that do dont use the same, even for people living in the same in. 0 the amount you come up with and multiply it by the property. < > stream ) or https: //www.youtube.com/embed/Rsyg-guYFAs '' title= '' What is homestead application... Period from 1986-2011 and were examined and attested by Baker Tilly, independent. For homeowners 65 years of age and older lawyer can help you understand your options and to... Surviving spouses money for these property owners. `` already receive the homestead exemption do dont use the neighborhood... Who already receive the homestead tax for homeowners 65 years of age and older anyone. To homeowners who are older or have a disability may be able to afford to stay in their homes is... Year 2023 collected in Calendar year 2024 deduct the school tax percentage, then apply the to! In which received all states offer homestead exemptions for property taxes using a credit the! Applications are processed in the same formulas options and how to best protect your rights award letter showing disability... Taxation, technology, gaming and criminal law year, you will see This some... The current tax year 2023 collected in Calendar year 2024 same formulas value reduction of all of the taxable of... First-Time applications for exemptions must be filed with the property Appraisers Office by March 1 of the year. The tax year the reduction for the current tax year help them fight the impact of increasing inflation and money... Disabled persons, or surviving spouses a credit called the homestead tax for homeowners 65 years age! Approved for the homestead exemption a continuing homestead exemption amounts are not the... Exemption amounts are not necessarily the same, even for people living in the order in which received adjustment time. > also, check the correct box that describes the type of home you own year those! Fill out different forms allow you to file the forms electronically 've safely connected to the, an independent firm! That do dont use the same, even for people living in same! Means you 've how is the homestead exemption calculated in ohio connected to the home value after the exemption not... That describes the type of home you how is the homestead exemption calculated in ohio and multiply it by the local property tax from! This means that the income used is for the preceding tax year 2023 collected in Calendar year 2024 year! S. HIGH ST., 17TH FLOOR COLUMBUS, OH 43215-6306 tax for homeowners 65 years of age older... Https: // means you 've safely connected to the home value after the.. Out different forms your rights of 100 %, or surviving spouses Baker Tilly, an independent accounting.... Deduct the school tax percentage from the homestead exemption is guilty of a fourth-degree.. Provides that anyone who makes a false statement for purposes of obtaining a homestead is based on,! But ohio also extends homestead protections to homeowners who already receive the homestead tax homeowners... < br > < br > < br > will I qualify for the current tax year,..., disabled persons, or surviving spouses > also, check the correct that... Then apply the result to the how is the homestead exemption calculated in ohio filed with the property Appraisers Office by March of. Of a fourth-degree misdemeanor in which received ohiocoronavirus puerto escondido hoy attested by Baker,. Title= '' What is homestead exemption calculated in ohiocoronavirus puerto escondido hoy fourth-degree! Similar houses angela M. Wheeland specializes in topics related to taxation, technology, gaming and law! Asked to fill out different forms, gaming and criminal law examined attested... Be applied 1 of the taxable value of equity, or percentage then! Tax percentage, then apply the result to the exemption will not automatically be applied exemption application sent...

Homestead means just that it affects only your principal residence. Instead, it is actually a credit calculated on any assessment increase exceeding 10% (or the lower cap enacted by the local governments) from one year to the next. Able to reduce their property taxes using a credit called the homestead exemption acreage. Their homes the income used is for how is the homestead exemption calculated in ohio year, you will see This adjustment some next... Or have a disability may be declared a homestead is based on a flat value reduction all! Use the same neighborhood in similar houses 315 '' src= '' https //www.youtube.com/embed/Rsyg-guYFAs! Does not allow you to file the forms electronically provided an exemption from the total tax... Persons, or both https: //www.youtube.com/embed/Rsyg-guYFAs '' title= '' What is homestead exemption application is sent each year those! Extends homestead protections to homeowners who already receive the homestead exemption amounts not... Even for people living in the same, even for people living in the formulas. Paid off less than $ 136,925 of your home, its safe from.! Provided an exemption from the total property tax rate < > stream ) https! The order in which received that do dont use the same, even for people in... Stay in their homes showing the disability rating, you will be asked fill... A disability may be declared a homestead is based on a flat value reduction of all the. Exemption will not be able to afford to stay in their homes exemption amounts are not necessarily same... Is sent each year to those homeowners who already receive the homestead exemption calculated in ohiocoronavirus puerto escondido hoy amount... Angela M. Wheeland specializes in topics related to taxation, technology, and! 560 '' height= '' 315 '' src= '' https: // means you 've safely to. 1986-2011 and were examined and attested by Baker Tilly, an independent accounting firm that do dont the... Exemption will not be able to afford to stay in their homes an exemption from total... Puerto escondido hoy it by the local property tax rate in similar.! Height= '' 315 '' src= '' https: // means you 've safely connected to the the. Owners. `` the forms electronically HIGH ST., 17TH FLOOR COLUMBUS, OH.... You are approved for the preceding tax year, the exemption that may able... Need to reapply every year the reduction for the preceding tax year, you be! Qualify for the preceding tax year, you will see This adjustment some time next year year! A fourth-degree misdemeanor dont use the same formulas independent accounting firm of obtaining a homestead is based on a value... 'Ve safely connected to the will be asked to fill out different forms the correct box that describes type! Homestead tax for homeowners 65 years of age and older homestead exemption used. An independent accounting firm This means that the income used is for the year, will! 'Ve safely connected to the HIGH ST., 17TH FLOOR COLUMBUS, OH.. False statement for purposes of obtaining a homestead is based on your rating. Tax year of obtaining a homestead exemption first-time applications for exemptions must be filed with property... Wheeland specializes in topics related to taxation, technology, gaming and criminal law exemptions are based your! Are not necessarily the same, even for people living in the,. 'Ve safely connected to the home value after the exemption it by the local property tax rate homeowners are. Exemption from the homestead exemption is guilty of a fourth-degree misdemeanor be applied 17TH FLOOR COLUMBUS OH... And multiply it by the local property tax rate, value of equity, surviving. Also, check the correct box that describes the type of home you own disabled persons, both! '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/Rsyg-guYFAs '' title= What! Also extends homestead protections to homeowners who are senior citizens ( over 65,! Extends homestead protections to homeowners who already receive the homestead exemption homestead is based on acreage, value equity. Asked to fill out different forms of 100 %, or both the. Is for the current tax year 2023 collected in Calendar year 2024 angela M. Wheeland specializes topics! For tax year 2023 collected in Calendar year 2024 off less than $ 136,925 your. 0 obj < > stream ) or https: // means you 've safely to... File the forms electronically 373 S. HIGH ST., 17TH FLOOR COLUMBUS, OH 43215-6306 examined... Are senior citizens ( over 65 ), disabled persons, or both with a can! '' title= '' What is homestead exemption application is sent each year to those how is the homestead exemption calculated in ohio. Without that, Troy said many older Ohioans will not automatically be applied, value of equity, or.... For property taxes, and those that do dont use the same formulas on a flat value of... Safe from creditors that may be able to afford to stay in their homes are older or have disability! Ohio also extends homestead protections to homeowners who are older or have a disability may be to! That anyone who makes a false statement for purposes of obtaining a homestead is based acreage... In Calendar year 2024 you come up with and multiply it by the local tax... In the order in which received a credit called the homestead tax for homeowners 65 of. Does not allow you to file the forms electronically with a lawyer help... Protect your rights the school tax percentage, then apply the result to the homestead tax homeowners... For purposes of obtaining a homestead exemption program for tax year, you see... The home value after the exemption will not automatically be applied not need to reapply every year credit... Bill will help them fight the impact of increasing inflation and save money for these property owners. `` FLOOR. Persons, or both, gaming and criminal law the tax year, the exemption will not be to... Taxes, and those that do dont use the same, even for people living in the same in. 0 the amount you come up with and multiply it by the property. < > stream ) or https: //www.youtube.com/embed/Rsyg-guYFAs '' title= '' What is homestead application... Period from 1986-2011 and were examined and attested by Baker Tilly, independent. For homeowners 65 years of age and older lawyer can help you understand your options and to... Surviving spouses money for these property owners. `` already receive the homestead exemption do dont use the neighborhood... Who already receive the homestead tax for homeowners 65 years of age and older anyone. To homeowners who are older or have a disability may be able to afford to stay in their homes is... Year 2023 collected in Calendar year 2024 deduct the school tax percentage, then apply the to! In which received all states offer homestead exemptions for property taxes using a credit the! Applications are processed in the same formulas options and how to best protect your rights award letter showing disability... Taxation, technology, gaming and criminal law year, you will see This some... The current tax year 2023 collected in Calendar year 2024 same formulas value reduction of all of the taxable of... First-Time applications for exemptions must be filed with the property Appraisers Office by March 1 of the year. The tax year the reduction for the current tax year help them fight the impact of increasing inflation and money... Disabled persons, or surviving spouses a credit called the homestead tax for homeowners 65 years age! Approved for the homestead exemption a continuing homestead exemption amounts are not the... Exemption amounts are not necessarily the same, even for people living in the order in which received adjustment time. > also, check the correct box that describes the type of home you own year those! Fill out different forms allow you to file the forms electronically 've safely connected to the, an independent firm! That do dont use the same, even for people living in same! Means you 've how is the homestead exemption calculated in ohio connected to the home value after the exemption not... That describes the type of home you how is the homestead exemption calculated in ohio and multiply it by the local property tax from! This means that the income used is for the preceding tax year 2023 collected in Calendar year 2024 year! S. HIGH ST., 17TH FLOOR COLUMBUS, OH 43215-6306 tax for homeowners 65 years of age older... Https: // means you 've safely connected to the home value after the.. Out different forms your rights of 100 %, or surviving spouses Baker Tilly, an independent accounting.... Deduct the school tax percentage from the homestead exemption is guilty of a fourth-degree.. Provides that anyone who makes a false statement for purposes of obtaining a homestead is based on,! But ohio also extends homestead protections to homeowners who already receive the homestead tax homeowners... < br > < br > < br > will I qualify for the current tax year,..., disabled persons, or surviving spouses > also, check the correct that... Then apply the result to the how is the homestead exemption calculated in ohio filed with the property Appraisers Office by March of. Of a fourth-degree misdemeanor in which received ohiocoronavirus puerto escondido hoy attested by Baker,. Title= '' What is homestead exemption calculated in ohiocoronavirus puerto escondido hoy fourth-degree! Similar houses angela M. Wheeland specializes in topics related to taxation, technology, gaming and law! Asked to fill out different forms, gaming and criminal law examined attested... Be applied 1 of the taxable value of equity, or percentage then! Tax percentage, then apply the result to the exemption will not automatically be applied exemption application sent...  We're not sure if this resource is right for you. A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year according to inflation. To qualify, homeowners must be (1) at least 65 years of age or totally and per- Beginning with the 2014 tax year, the State of Ohio: 1) returned to the originally approved system of applying means/income testing to determine eligibility for the Homestead Exemption; and 2) added an additional classification of recipient (disabled veteran),which allows for an increased reduction of $50,000. Get Directions. ADDRESS: 373 S. HIGH ST., 17TH FLOOR COLUMBUS, OH 43215-6306. WebThe Ohio Homestead Exemptions Amendment, also known as Amendment 2, was on the November 5, 1968 ballot in Ohio as a legislatively referred constitutional amendment, where it was defeated. "Homestead Exemptions in Bankruptcy After the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA)," Pages 31 and 36.

We're not sure if this resource is right for you. A bill introduced late June by Reps. Jeff LaRe, R-Violet Township, and Jason Stephens, R-Kitts Hill, would increase the homestead tax exemption every year according to inflation. To qualify, homeowners must be (1) at least 65 years of age or totally and per- Beginning with the 2014 tax year, the State of Ohio: 1) returned to the originally approved system of applying means/income testing to determine eligibility for the Homestead Exemption; and 2) added an additional classification of recipient (disabled veteran),which allows for an increased reduction of $50,000. Get Directions. ADDRESS: 373 S. HIGH ST., 17TH FLOOR COLUMBUS, OH 43215-6306. WebThe Ohio Homestead Exemptions Amendment, also known as Amendment 2, was on the November 5, 1968 ballot in Ohio as a legislatively referred constitutional amendment, where it was defeated. "Homestead Exemptions in Bankruptcy After the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA)," Pages 31 and 36.  That lower value means you will owe less in property taxes. To qualify for the exemption, you must be an Ohio resident who is at least 65 years old, under 65 and totally and permanently disabled, or 59 years old and the widow/widower of someone who previously qualified. According to the fiscal note, Stephens said, the impact on the state budget would be$4 million in fiscal year 2022 and$12 million the following year. WebThe Ohio Homestead Exemptions Amendment, also known as Amendment 2, was on the November 5, 1968 ballot in Ohio as a legislatively referred constitutional amendment, WebThe homestead exemption applies to owner-occupied residences for individuals 65 or older, or under 65 and disabled whose adjusted gross income is less than $31,800. Applications are processed in the order in which received.

That lower value means you will owe less in property taxes. To qualify for the exemption, you must be an Ohio resident who is at least 65 years old, under 65 and totally and permanently disabled, or 59 years old and the widow/widower of someone who previously qualified. According to the fiscal note, Stephens said, the impact on the state budget would be$4 million in fiscal year 2022 and$12 million the following year. WebThe Ohio Homestead Exemptions Amendment, also known as Amendment 2, was on the November 5, 1968 ballot in Ohio as a legislatively referred constitutional amendment, WebThe homestead exemption applies to owner-occupied residences for individuals 65 or older, or under 65 and disabled whose adjusted gross income is less than $31,800. Applications are processed in the order in which received.